Why the Fed Should Cut 50 BPS Next Week

The Path Forward

Walt Disney emphasized the importance of adaptability and forward-thinking in his quote “Times and conditions change so rapidly that we must keep our aim constantly focused on the future.” For Jerome Powell and the Federal Reserve — the future is now.

The economic landscape is shifting fast. Job revisions show the labor market was much weaker than previously thought, August payrolls barely grew, jobless claims have broken out to the upside, and job openings now sit roughly one-for-one with unemployed workers — the softest balance since 2021. Households feel it too, with job-finding confidence sliding to a series low. At the same time, inflation has not reignited: CPI rose 0.4% m/m and 2.9 y/y in August with core at 3.1% y/y, PPI dipped 0.1% m/m, and tariff pass-through looks muted outside a handful of goods categories. All together, the dual mandate is flashing asymmetry: employment is deteriorating faster than prices are rising.

The policy takeaway is straightforward. A front-loaded 50 bps move would better align policy with the true state of the economy revealed by revisions and leading indicators, while preserving the ability to slow or pause if inflation were to re-accelerate. Waiting for perfect clarity risks compounding damage to jobs and confidence, raising the odds that larger and more disruptive cuts would be needed later.

Labor Market: From “Cooling” to “Cracking”

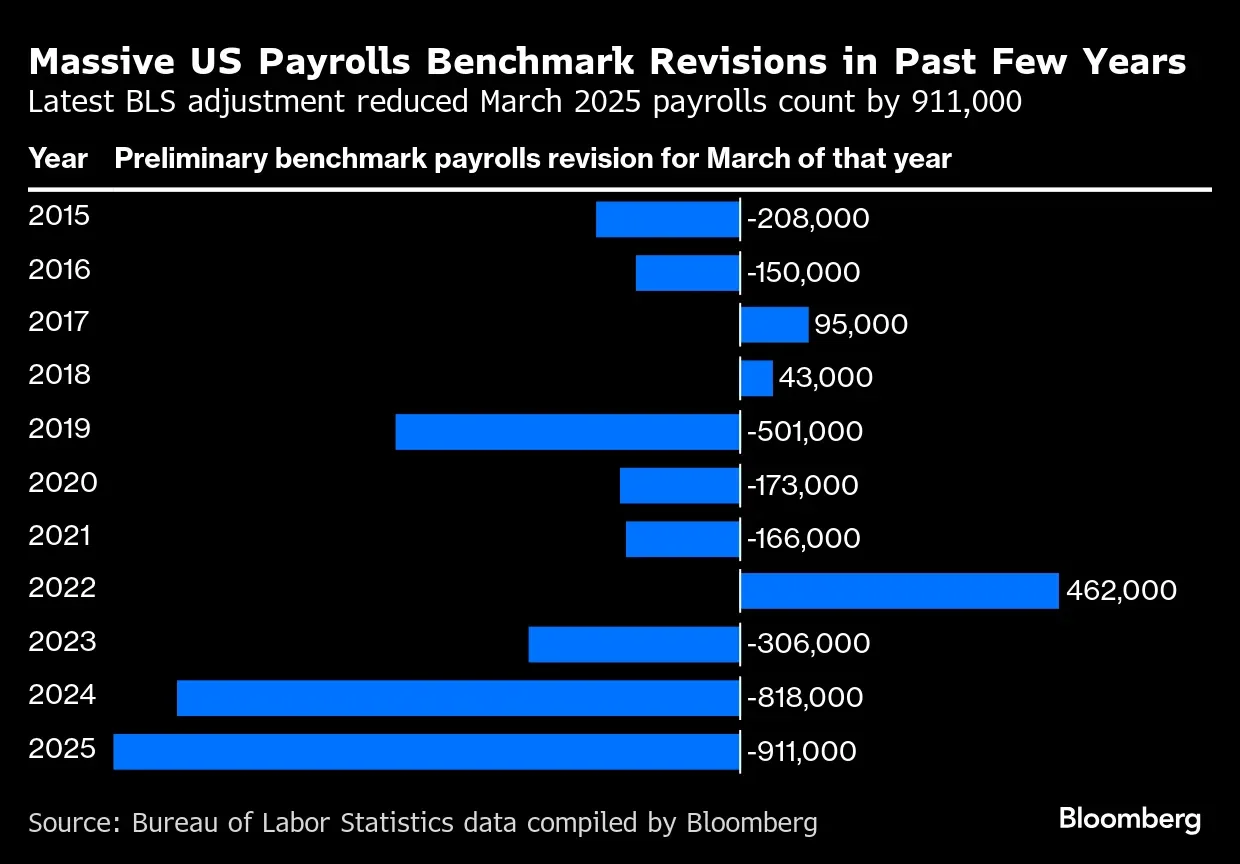

The jobs picture got a reality check last week. The BLS reported that the U.S. economy added roughly 911,000 fewer jobs over the twelve months through March than previously reported. That revision strips away the cushion many had assumed existed and reframes 2024-25 as a period of far less underlying momentum. The subsequent monthly prints are consistent with that view. August non-farm payrolls rose by only 22,000, while earlier months were marked down, including June turning negative after revision. Unemployment has drifted into the mid-4s, and hirings have cooled from the torrid clip of post-COVID 2021-22.

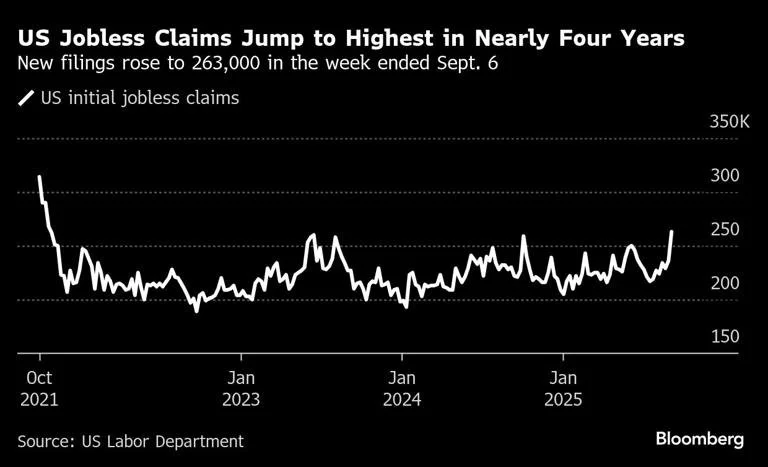

Leading indicators confirm the down-shift. Initial jobless claims have moved up to around 263,000, the highest since 2021, and continuing claims remain sticky near two million, suggesting displaced workers are taking longer to find new roles. The demand side of the market has reset as well: JOLTS opening fell to roughly 7.2 million in July, leaving about one job per job seeker — a far cry from the abundance of 2022. Qualitatively, quits remain subdued and anecdotal reports point to selective layoffs, hiring freezes, and higher headcount budgets.

Households see what the data show. The New York Fed’s Survey of Consumer Expectations reports job-finding confidence near 45%, the lowest since the series began in 2013. Taken together, this is no longer a gentle cooling; it is a labor market that has lost altitude. With less cushion than assumed and forward-looking indicators worsening, the employment side of the mandate argues for faster policy adjustment, not incrementalism.

Inflation: Not a Rerun of 2022

Inflation is still above the Fed’s 2% goal, but the recent pattern does not resemble a new breakout. Headline CPI rose 0.4% on the month and 2.9% on the year in August, while core CPI advance 0.3% m/m and 3.1% y/y. Meanwhile, PPI declined 0.1% m/m, and the distribution of price changes looks more balanced than during the 2021-22 surge, with services margins easing even as a few goods categories face tariff-related pressure. Importantly, measures of medium-term inflation expectations remain anchored, and the “supercore” services basket has cooled from last year’s highs even if shelter disinflation is proceeding gradually.

None of this says the inflation fight is over. It does say the near-term risk is skewed away from imminent re-acceleration and toward a growth and jobs slowdown. That is precisely when preemptive easing is most effective: it leans against deteriorating demand without giving up credibility on price stability.

What Fed Officials & Economists Are Signaling

Fed communication has turned notably more balanced. Chair Powell’s recent remarks acknowledged that the labor market has “cooled” and that the rise in unemployment is historically meaningful, a diplomatic way of signaling that risks have shifted toward employment. Governor Waller (one of Trump’s favorites to be the next Fed Chair) has been more explicitly arguing that weaker-than-advertised job creation and recent revisions justify easing with the pace determined by incoming data. Outside the Fed, international institutions such as the IMF note the U.S. now has room to lower rates given labor deterioration and moderating demand. Street economists, meanwhile, broadly expect a cut next week. While 25 bps remains the expectation, the case for 50 bps has increased as claims rise and the benchmark revision reverses what was thought to be robust job growth in 2024.

Why 50 > 25 Right Now

A larger first step would correct a mis-calibration created by misleadingly strong payroll prints and would better align real rates with the softer growth backdrop. It would also buy insurance at a time when inflation is not re-accelerating, reducing unemployment risk before it hardens into broader layoffs. Crucially, a 50 bps move clarifies the signal: The Committee is honoring both legs of its mandate by addressing a weakening labor market while keeping the option to pause if prices flare. By acting decisively now, the Fed preserves optionality later — whereas a token 25 bps cut risks under-delivering into deterioration and invites tighter financial conditions if markets doubt the Fed’s resolve.

What Odds Say — and Why a 25 BPS Cut Risks a “sell-the-news” Drop

Prediction markets are squarely leaning toward a 25 bps cut. On Polymarket’s “Fed decision in September” contract, the 25 bps decrease outcome has been trading around the mid-80s%, with ~10% for a 50+ bps move and only a few percent for no change. Fed funds futures echo that base case: CME’s FedWatch shows markets assigning ~85–90% odds to a 25 bps cut, with a smaller tail for 50.

That setup makes a “sell-the-news” reaction more likely if the Fed delivers only 25. With labor softening and real rates still restrictive, a quarter-point — especially if paired with cautious dots and Powell stressing that the Committee will “proceed carefully” — could be interpreted by the market as too little, too late. In that scenario, I imagine equities would fade an initial pop as growth concerns reassert: cyclicals underperform, high-yield spreads widen, belly yields dip but the long end lags (bearish for risk parity), and the USD firms on relative policy restraint abroad. The market wants confirmation that the Fed is moving decisively to arrest the labor slowdown — a 25 bps “under-delivery” raises the odds that policy will chase the downturn, not preempt it.

Tactically, watch three tells for a sell-off after a 25 bps cut:

1) The Summary of Economic Projections showing only a shallow 2025 cut path,

2) Powell downplaying claims/JOLTS deterioration; and

3) Any pushback on 50 bps “now” in favor of step-downs later.

If those land hawkish, the path of least resistance is lower for stocks — even with the cut priced in.

As is the norm here at Fast Break Finance, I’ll leave you with a jam that fits the topic. Since we’re talking about 50 bps, I can’t think of anything better than some 50 Cent.

- Brian T. Lichtor